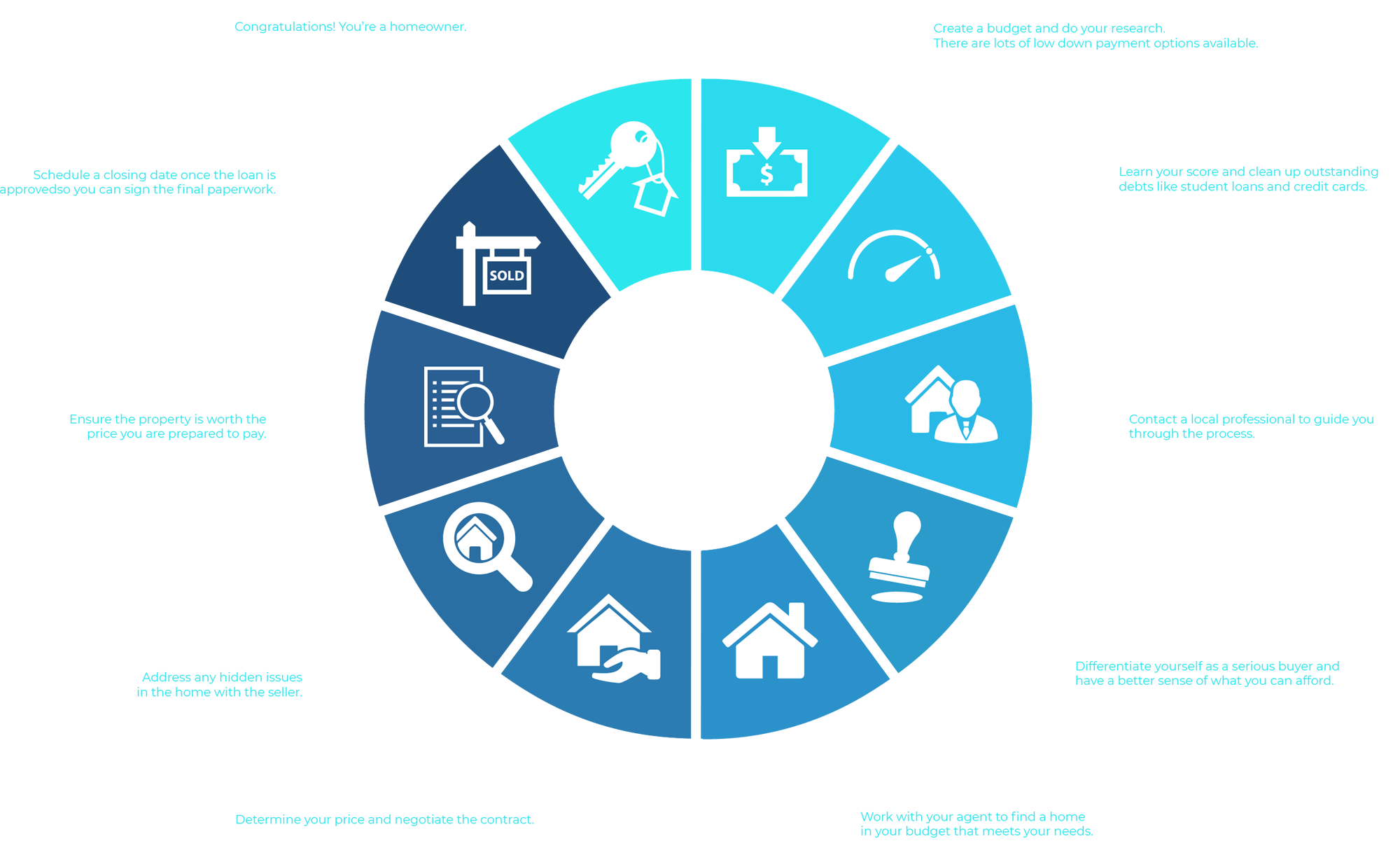

- Save for Your Payment – Create a budget and do your research. There are lots of low down payments available.

- Know Your Credit Score – Learn your score and clean up outstanding debts like student loans and credit cards.

- Find a Real Estate Agent – Contact a local professional to guide you through the process.

- Get Pre-Approved – Differentiate yourself as a serious buyer and have a better sense of what you can afford.

- Find a Home – Work with your agent to find a home in your budget that meets your needs.

- Make an Offer – Determine your price and negotiate the contract.

- Have a Home Inspection – Address any hidden issues in the home with the seller.

- Get a Home Appraisal – Ensure the property is worth the price you are prepared to pay.

- Close the Sale – Schedule a closing date once the loan is approved so you can sign the final paperwork.

- Move In – Congratulations! You’re a homeowner.

Buyers

A Buyer’s Agent is a Licensed Real Estate Professional who is dedicated to representing the interests of people looking to purchase property. As Buyer’s Agents, we assist you in the mortgage pre-approval process, conduct property searches specific to your criteria, schedule tours, negotiate offers & contingencies, coordinate inspections, and assist you through the closing paperwork.

Our goal is to make the transition into your new home as smooth as possible. Once we have a better understanding of what it is that you are looking for, finding your perfect home is simple.

Residential Services

Before you begin your new home search, you should ask yourself a few questions

• Where do you want to live?

• Is living close to work important?

• What are your must have interior features (master bathroom, fireplace, first floor bedroom)?

• What are your must have exterior features (garage, fenced in yard, pool)?

• What are the property taxes?

• Have you consulted a lender to determine the best price range?